FOR IMMEDIATE RELEASE

Contact: Retonjah Burdette, Communications Manager

City of Clarkston

Phone: 404-834-2211

Email: rburdette@cityofclarkston.com

City of Clarkston Announces Public Hearings on House Bill 581: Floating Homestead Exemption

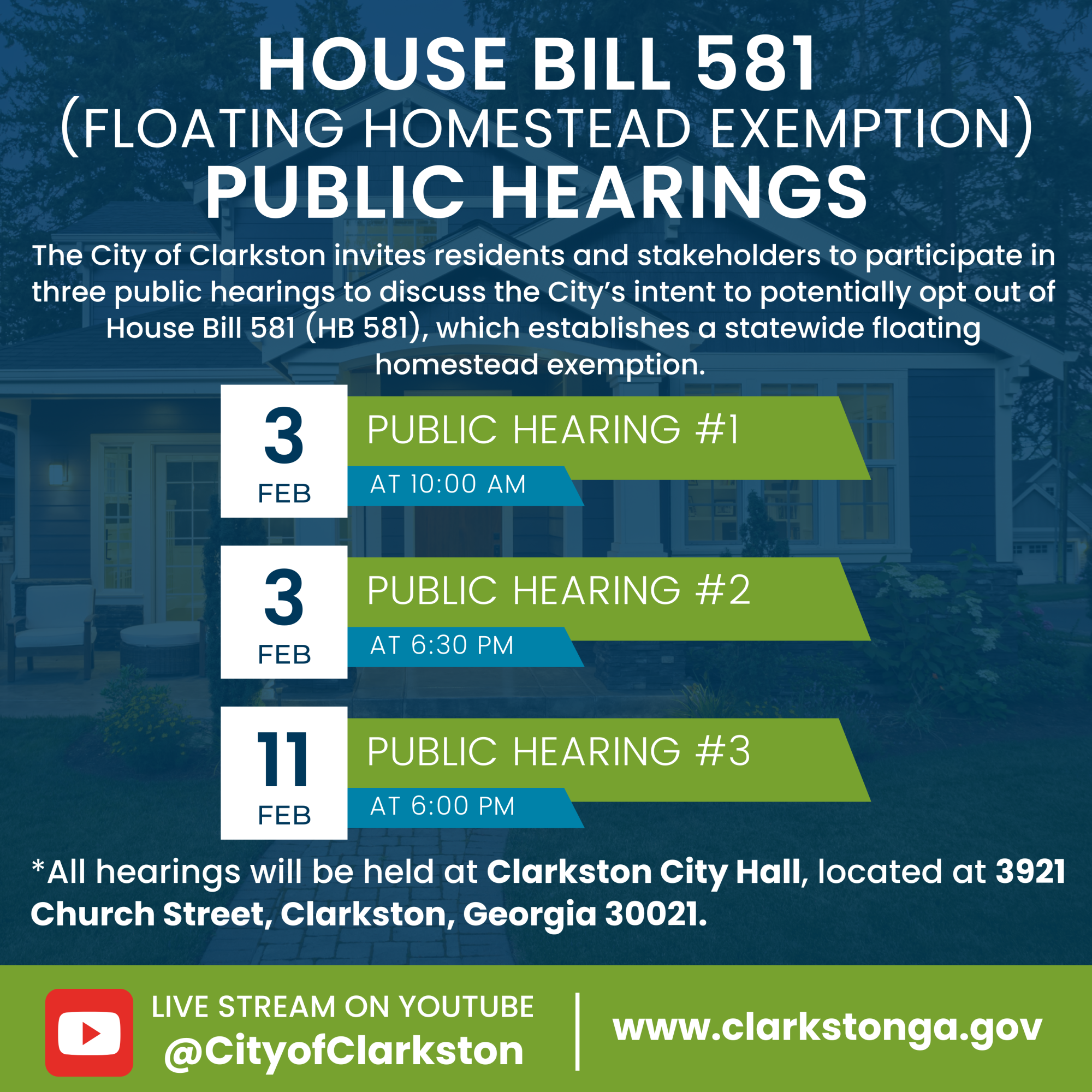

Clarkston, GA, January 23, 2025 — The City of Clarkston invites residents and stakeholders to participate in three public hearings to discuss the City’s intent to potentially opt out of House Bill 581 (HB 581), which establishes a statewide floating homestead exemption. This decision carries significant implications for property tax assessments and local government revenues.

What is House Bill 581?

Signed into law by Governor Kemp in April 2024, HB 581 introduces an adjusted base-year homestead exemption statewide. This exemption caps annual increases in the taxable value of residential properties at the inflation rate, offering homeowners a degree of predictability and protection against sharp tax increases.

However, local governments, including counties, cities, and school districts, have the option to opt out of this exemption. If a jurisdiction does not opt out by March 1, 2025, the exemption becomes permanent, and local homeowners automatically benefit from capped tax increases under HB 581. Opting out would maintain the status quo, preserve current property tax structures, and enable local governments to pursue other property tax relief strategies if desired.

Why Opt Out?

The City of Clarkston is considering opting out to maintain greater flexibility in local tax policies. This includes preserving its ability to use existing homestead exemptions.

Public Hearing Schedule

Community input is critical to this decision. The City of Clarkston will hold three public hearings to provide information, answer questions, and gather feedback:

- Public Hearing #1: February 3, 2025, at 10:00 AM

Register in advance for this webinar: https://us02web.zoom.us/webinar/register/WN_NaGwc7teTMGoMFlkBU0czA

- Public Hearing #2: February 3, 2025, at 6:30 PM

Register in advance for this webinar: https://us02web.zoom.us/webinar/register/WN_eOBmVJcWQy23uBq8m8OH9g

- Public Hearing #3: February 11, 2025, at 6:00 PM

Register in advance for this webinar: https://us02web.zoom.us/webinar/register/WN_Ob0GJaPaRneCj6TGK6GZKg

All hearings will be held at Clarkston City Hall, located at 3921 Church Street, Clarkston, Georgia 30021. For those unable to attend in person, the hearings will be streamed on the City of Clarkston’s official YouTube channel (@cityofclarkston). Public comments can also be made via Zoom using the links provided above.

What’s at Stake?

Opting out of HB 581 ensures that the City retains control over its approach to property tax policies while allowing homeowners to continue benefiting from any existing exemptions. However, if the City does not opt-out, the exemption outlined in HB 581 will become permanent, and homeowners’ property tax assessments will be capped at inflation-based increases.

How to Get Involved

The City encourages all residents and business owners to attend the hearings or watch the livestream. Public participation is essential to ensure the decision aligns with the needs and priorities of the community.

For more information on HB 581, please visit https://www.accg.org/links/HB%20581%20FAQs%20-%20FINAL%201.1.pdf or contact Finance Director Lolita Grant at lgrant@cityofclarkston.com.

###