CITY OF CLARKSTON PRESS RELEASE

ANNOUNCING A PROPOSED PROPERTY TAX INCREASE

The City of Clarkston City Council today announces its intention to increase the 2023 Property Taxes it will levy this year by 41.21 percent over the Rollback Millage Rate.

Each year, the board of tax assessors is required to review the assessed value for property tax purposes of taxable property in the county. When the trend of prices on properties that have recently sold in the county indicate there has been an increase in the fair market value of any specific property, the board of tax assessors is required by law to re-determine the value of such property and adjust the assessment. This is called a reassessment.

When the total digest of taxable property is prepared, Georgia law requires a rollback millage rate must be computed that will produce the same total revenue on the current year’s digest that last year’s millage rate would have produced had no reassessments occurred.

The budget tentatively adopted by the City of Clarkston requires a millage rate higher than the rollback millage rate; therefore, before the City of Clarkston City Council may finalize and set a final millage rate, Georgia law requires three public hearings to be held to allow the public an opportunity to express their opinions on the increase.

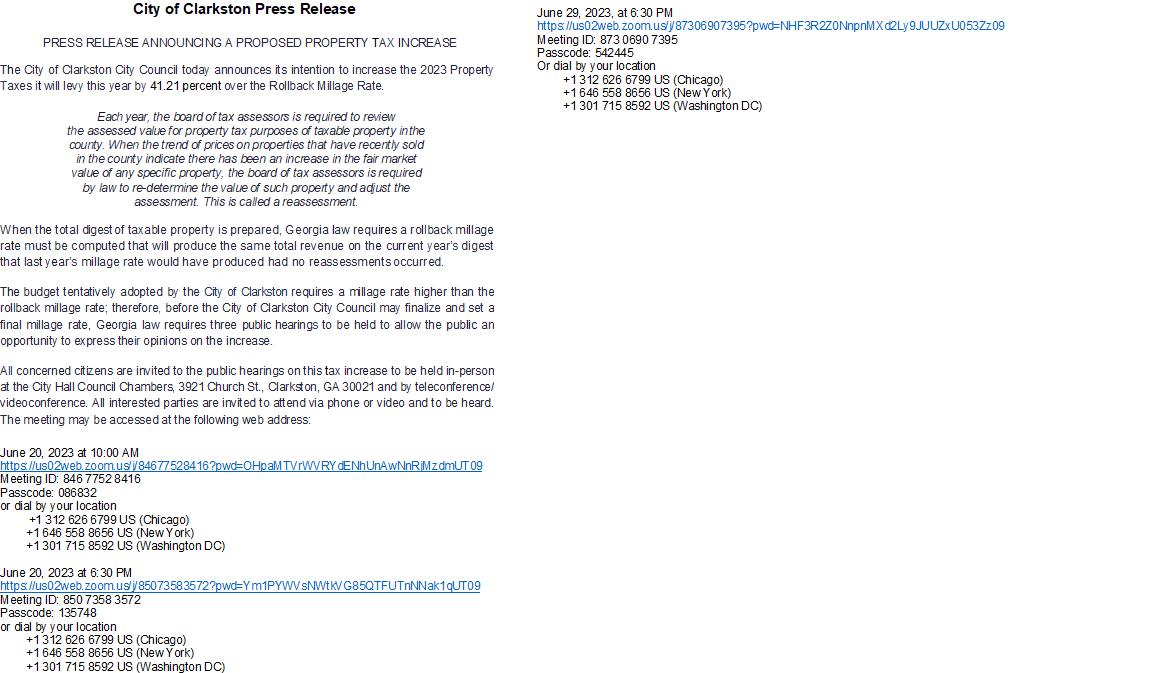

All concerned citizens are invited to the public hearings on this tax increase to be held in-person at the City Hall Council Chambers, 3921 Church St., Clarkston, GA 30021 and by teleconference/ videoconference. All interested parties are invited to attend via phone or video and to be heard. The meeting may be accessed at the following web address:

June 20, 2023 at 10:00 AM

Please see the agenda here.

https://us02web.zoom.us/j/84677528416?pwd=OHpaMTVrWVRYdENhUnAwNnRjMzdmUT09

Meeting ID: 846 7752 8416

Passcode: 086832

or dial by your location

+1 312 626 6799 US (Chicago)

+1 646 558 8656 US (New York)

+1 301 715 8592 US (Washington DC)

June 20, 2023 at 6:30 PM

Please see the agenda here.

https://us02web.zoom.us/j/85073583572?pwd=Ym1PYWVsNWtkVG85QTFUTnNNak1qUT09

Meeting ID: 850 7358 3572

Passcode: 135748

or dial by your location

+1 312 626 6799 US (Chicago)

+1 646 558 8656 US (New York)

+1 301 715 8592 US (Washington DC)

June 29, 2023, at 6:30 PM

Please see the agenda here.

https://us02web.zoom.us/j/87306907395?pwd=NHF3R2Z0NnpnMXd2Ly9JUUZxU053Zz09

Meeting ID: 873 0690 7395

Passcode: 542445

Or dial by your location

+1 312 626 6799 US (Chicago)

+1 646 558 8656 US (New York)

+1 301 715 8592 US (Washington DC)

DOWNLOAD BELOW TO VIEW 2023 PROPOSED MILLAGE RATE DOCUMENTS:

2023 PRESS RELEASE (PDF)

CURRENT 2023 PROPERTY TAX DIGEST AND 5 YEAR HISTORY OF LEVY

2023 COMPUTATION OF MILLAGE RATE ROLLBACK AND PERCENTAGE INCREASE IN PROPERTY TAXES

2023 NOTICE OF PROPERTY TAX INCREASE